I will refrain from expressing my concern, as I do not believe a house-price lead recovery is a good thing, but I’ve already written that “Pensions freedoms shouldn’t increase property prices (but may well do so)“. I think these stamp duty changes are a thinly veiled attempt to perpetuate the diminishing effects of quantitative easing, funding for lending, help to buy and the other measures intended to stave the British economy from recession.

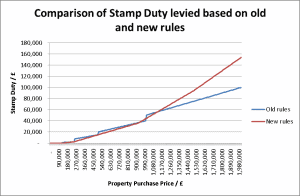

The mainstream report of the reduction in stamp duty has highlighted the broad savings, HM Treasury’s own news release highlights the £4,900 saving on the average London home, which is valued at £510,000.

There’s almost certainly no coincidence that these bands have been chosen to have a significant impact; both politically but also due to the stimulus to the housing market. The first point will be obvious to most, but it strikes me the impact to property prices will be more significant than appreciated.

The average London home, as explained above, is valued at £510,000, in Caterham this would get you a sizeable three or four bedroom house, often detached. The individual purchasing this house may be ‘upsizing’ from a two or three bed, and of course, likely to be arranging a mortgage.

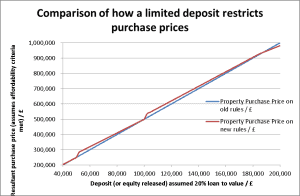

Much has been publicised about mortgage borrowing, but banks will still lend if affordability stacks up, and a sufficient deposit is raised. I understand that 4-5 times earnings and 80% loan to value mortgages are available. So to purchase this hypothetical house, a family would need to demonstrate (broadly) £81,600 – £102,000 of joint income (wealthier than average but certainly feasible), and a deposit, or importantly equity from their prior sale, of £102,000 – after costs, which include stamp duty.

The saving of £4,900 of stamp duty does not simply allow them to spend an additional £4,900 on a house, in many cases they can match this with four times as much from the bank’s money (where earnings justify) for a total additional purchase price of £24,500. If we suspend our views on the wisdom of spreading this additional borrowing over a number of years this is a huge impact, further compounded by those looking to purchase their house have more to spend too. If they’re moving from a £300,000 property their purchaser is saving £4,000, which when matched with bank lending could be £20,000 total, etc. etc.!

The benefit reduces to zero at £937,500 of purchase price, and whilst there is an anomaly just over £1m, the stimulus will principally effect houses below this level. Nevertheless the virtuous circle (if you consider it that way) will impact throughout the market, as each stage in a chain where finance is being arranged have more funds to apply to a deposit.

And if this means higher house prices, that’s more stamp duty for HM Treasury!