Changes to Pension in the 2014 Budget: The immediate, the proposed and the speculative

The biggest shock in the Budget, and the area that has gained the greatest press coverage, has been the removal of restrictions on pension withdrawals. To be clear, the final rules will be subject to final consultation and are not likely to be in place until April 2015 at the earliest, but we expect that […]

Five apparent inconsistencies in reporting the pension changes in the 2014 Budget

Pensioners will splurge their funds A significant number might, but then many will not. We have a 25% tax-free lump sum now, and the individuals I advise invariably do not take the lump sum at all, preferring to ‘phase’ it over many years, in what feels like a tax-free income. Those who do take it, […]

Just because it’s legal: some of the risks of Flexible and Capped Drawdown

Just because something is legal, it doesn’t mean it’s a good idea. Drawdown is a case in point, and with an embracingly permissive budget the ability to do harm has increased. Changes to both Capped and Flexible Drawdown mean that from next Thursday an individual can: take 25% more from their pension plan under Capped […]

Advice is expensive

Financial advice is expensive, right? The cost of a professional trained individual, working for a Chartered Financial Planning practice, sitting down with you, helping to identify your aims and objectives, explain the nature and value of your financial plans, and showing you the steps you need to take to get on track, must cost quite […]

Transferrable Annuities: A red herring?

Having filled itself with Christmas cheer, the pensions world came back in January to much silliness and talk of transferable annuities. Whilst Steve Webb should be applauded for keeping the debate going over the broken annuity market, transferable annuities already exist – they are called Short Term Annuities and in my mind add complication and […]

YOU control your retirement date, not the State!

In my first years in Financial Services, which were also my first years of full time employment, I made the choice to pay little regard to State Pension provision. When it was possible to ‘contract out’ of the second tier of the state pension I did, despite the commonly held belief it was not in […]

Best Retirement Adviser 2014 Shortlist

Wingate Financial Planning, one of Surrey’s leading firms of Chartered Financial Planners is delighted to announce we have been shortlisted as one of Money Marketing’s candidates for “Best Retirement Adviser”. The next stage in the process is an in depth interview in the New Year, and we will keep you informed of the results, which […]

Money Advice Service “not fit for purpose”

A report issued today gives a scathing assessment of the Money Advice Service, which is tasked with helping individuals to manage money better and funded by other Financial Services Professionals. I fail to see the need for such a service not least its £80m annual budget. Broadly speaking individuals fall into three categories: Those who […]

Triple Gold Winning Financial Advisers

We are proud to announce that Wingate Financial Planning have won the prestigious Gold Standard for Financial Advice for the third consecutive year. The award, was presented in a private ceremony on Wednesday evening at the House of Commons. We were delighted by the assessment of the judges: Wingate Financial Planning has a crystal clear […]

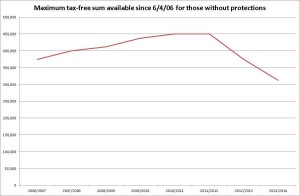

HM Treasury: Stop tinkering, pensions’ tax-free cash already has a cap!

A quick Google search will highlight the number of times capping of pension’s tax-free cash has been floated. What is often forgotten is that a pension’s tax-free cash cap was introduced in April 2006 and is actually lower than it has ever been. Final Salary schemes, which are generally generous in other regards, have been […]