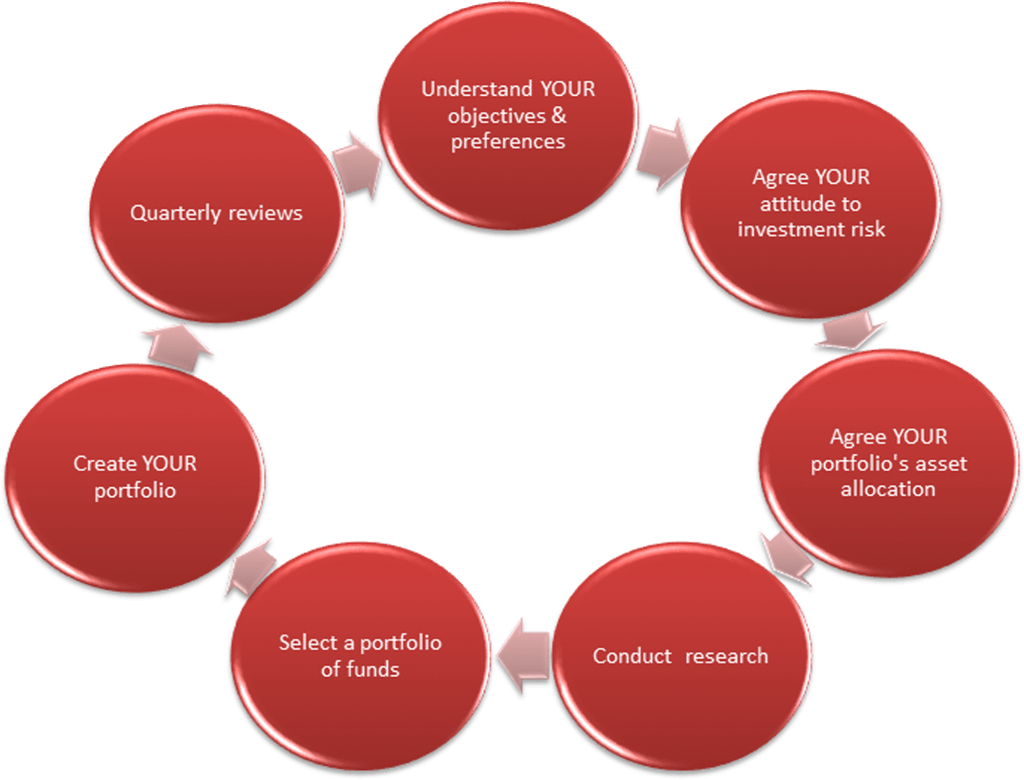

Our Investment Process

Introduction This document is a reference point for understanding how we provide investment advice to our clients. It is used and understood by everyone within our business, not just those responsible for the provision of advice, as it summarises not only our processes but our core beliefs and philosophies. Each client is different, so we […]

Issues with Property as an Investment Class

The current Government really doesn’t like properties that are owned by anyone other than the occupier. The last two Budgets have seen a tax on buy to let landlords, in the form of removing higher rate tax relief on mortgage interest payments in the July Budget and adding an additional 3% stamp duty in December. The […]

Flat Rate Pensions Tax Relief

I have lost count of the many times that I have started a blog post by explaining that the forthcoming changes to pensions will be the most radical we have seen for many years but if the 16th March 2016 Budget is as I expect it will be, in this case there is no hyperbole. The […]

Questions to ask a Financial Adviser, Financial Planner or Wealth Manager (original post)

The original blog will be updated as an ongoing resource here. Today, Unbiased launched a guide to selecting an adviser. We think it is good, and could be augmented with something we prepared, and supplied potential clients, some time ago. Five questions to ask your Financial Adviser, Financial Planner or Wealth Manager: What level of […]

Tax relief on pensions at up to 60% – buy now while stocks last?

We had hoped to see some news on how pensions tax-relief would look in the new, post consultation regime by now; it seems the Chancellor will give us the relevant detail in the March budget. We do know contributions for additional rate tax payers (45%) will, in most circumstances, fall to as low as £10,000. […]

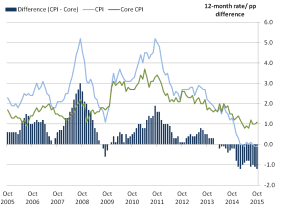

2015.12: December Economic Review

Main points GDP growth has been slightly slower during 2015 than in 2014, and this pattern continued with quarter-on-quarter growth of 0.5% in the third quarter of this year. Annual CPI inflation has been flat at close to zero for most of 2015. This is a step down from the average rate of inflation during […]

Can you now just have a UK Will?

Whilst we deal principally with clients who are resident and domiciled in the UK, some of them have international assets, particularly in Europe, and have read in popular media the potential of now only having an English Will, as opposed to needing one in the country in which assets are owned. There has been significant […]

Investing lessons from 114 years of data

The Barclays Equity Gilt Study is the UK’s leading source of data and analysis on long-term market returns. “Time in the market is more important than timing the market,” goes the old investment adage. In other words: it is very difficult to know when prices are likely to rise or fall, so most people will […]

The Fiasco of Individual and Fixed Protection 2016

With a little over four months to go until the new tax year and the reduction of the lifetime allowance from £1.25 million to £1 million the precise terms and conditions which will govern the protection of those with benefits above, or close to the lifetime allowance are yet to be defined. There have been […]

Pension freedoms increase the need for lasting powers of attorney

A Lasting Power of Attorney (LPA) is a legal document that allows an individual (known as a donor) to appoint one or more people (none as Attorneys) to help them make decisions on their behalf. There are two types of LPA: Health and Welfare Property and Financial Affairs Changes to pensions introduces in April 2015 […]