Treasury flags up further attacks on personal service companies

HM Treasury staff appear to be briefing the press that the Autumn Statement will force contractors paid through personal service companies (PSC) to go onto PAYE after only one month of working for a single employer. The PSC stories have appeared in several newspapers two weeks before the chancellor’s statement, which is scheduled for 25 […]

What’s going on with our pensions? Pension consultation deferral

Possible changes to pensions following the most recent Pension Consultation initiated by George Osborne post his July 2015 Budget seem unlikely to see the light of day until March 2016 at the earliest. This suggests that any alterations are likely to be a little more radical than purely tinkering around the pension edges. As a […]

2015.11: November Economic Review

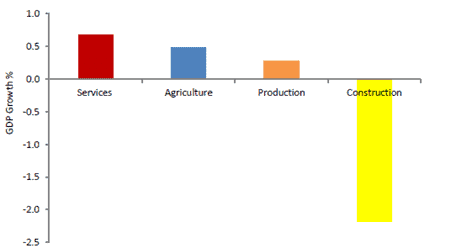

Highlights The UK economy continues to grow at a reasonable rate GDP growth in Q3 2015 was almost entirely driven by the services sector UK employment is at its highest since records began Real wages are now rising at a good rate and will help to support consumer spending, a key driver of UK growth […]

£750 million of Potential Tax raised in Six Months

HMRC have published figures showing that in the period from April to June, inclusive of 2015, £1.5 billion of pension payments were made under the new Flexibility Rule. In the period August to the end of October, an additional £1.2 million was paid for a total of £2.7 billion. We estimate, somewhere between two thirds […]

A personal response to HM Treasury’s consultation: “Strengthening the incentive to save: a consultation on pensions tax relief”

The blog below is the text of a response I wrote to the treasury consultation document. Whilst reproduced here it was prepared without consultation within the firm or by our clients and is a personal view only. The consultation is now closed, but the questions and my responses are recorded for context, and in the light of […]

2015.10: October Economic Review

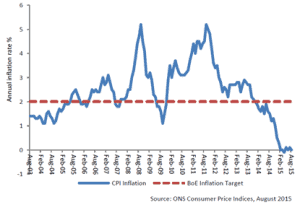

Highlights UK GDP 5.9% above the pre-recession peak Inflation remain low and Interest Rates held at 0.5%, with British Chambers of Commerce predicting a rise to 0.75% in Q2 2016 Renewed momentum in global equities and bonds, driven largely by a strong performance in Emerging Markets Economic Review The third official estimate of Q2 GDP […]

How will the cap on care costs actually work?

Introduction As a Financial Planner I spend time helping and guiding clients through the challenge of care fees planning. As the population ages, and live longer lives, the number of us requiring long-term care in later life is rising and at a pace. Following the delay in the introduction to the cap on care costs […]

State Pension Post 6th April 2016 – Some Facts

As is becoming increasingly prominent in the Press, the State Pension is changing. For those retiring after 6th April 2016, males born after 6th April 1951 and females born post 6th April 1953 you will be eligible for the full new State Pension of £151.25 per week; this amount maybe subject to change in the […]

Deflation – a bad thing for pensions

Today’s announcement that the consumer price index (CPI) has seen a decrease (-0.1%) over the past year will be bad for both current pensioners, and many individuals with final salary benefits. CPI is the government’s preferred measure of inflation; cynics might say this is because it has historically been lower than the retail price index, the […]

Time travel: the only way to guarantee the best investment returns

It’s nearly thirty years to the day that Marty McFly set out in his time machine1. He left 1985, and will arrive with us on 21st October 2015. Now, with thirty years of history we know how his infallible knowledge of the future will have lead him to invest after he returns to 1985? It wasn’t a […]