Our investment strategies are typically very simple looking to invest in a wide range of investment assets that will perform in different ways in different market conditions.

Accepting that markets will move unpredictably in the short term, a widely diversified portfolio should return in excess of cash over the longer term. We feel this neutral approach gives our clients, who typically have investment timeframes measured in decades, the best opportunity to succeed with their plans.

We have written on these pages before that we are negative about more complicated arrangements, and in particular “absolute return strategies” that intend to give positive returns irrespective of market conditions. For us, these have always promised the untenable and there is now strong evidence that these funds are not achieving their aim.

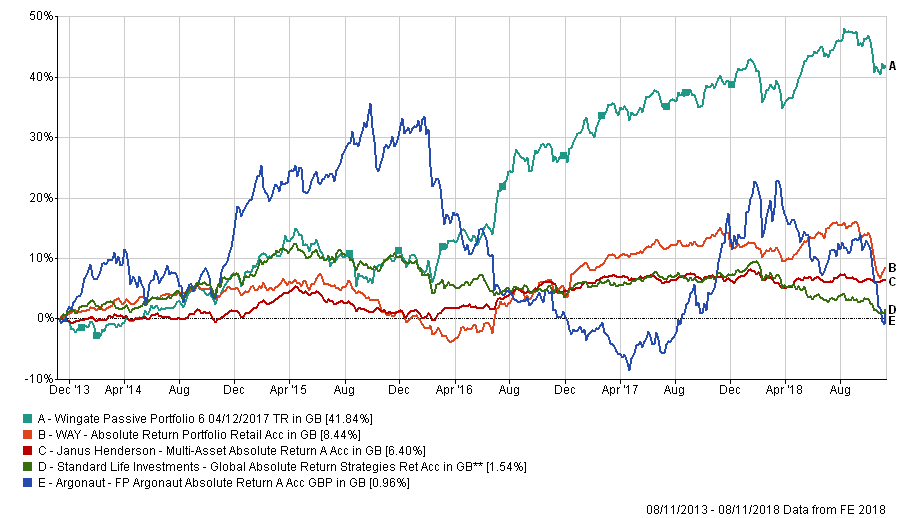

One of our principal concerns with these investment funds is that they are extremely complicated and very expensive, and being able to explain them to our clients we have avoided them. We also took with a strong pinch of salt promises made and the graph below gives an example of what has been achieved over the medium term (five years) providing some evidence that we were correct in our assessment.

It should be noted the absolute funds have very different costs (total fees expressed as between 1.3%-2.4% per annum), have different risk profiles, and may not be directly comparable, the funds were selected to show the sector is diverse, and that no clear trends on the “journey” emerge, but with the “destination” being very similar. The multi-asset passive solution, as described above, is what we would call “medium risk” and of course individual recommendations vary between clients.

One of “Absolute Return” fund,which is also one of the largest in the sector has an impenetrably complex investment strategy that aims to achieve 5% over cash (6 Month GBP LIBOR) in rolling three year periods – before fees. It is hard to assess the risk that has actually been taken due to the method of valuing assets within the scheme. Common with the funds above, the actual returns in the period shown is not close to the target.

The key point this piece tries to raise is that I have a general feeling, that if an investment sounds too good to be true, it usually is. In the case of Absolute Return funds we believe this shows some vindication of our avoidance of these strategies.