Home » Wingate Financial Planning Active Model Portfolios » Long-term for risk profile 9/10

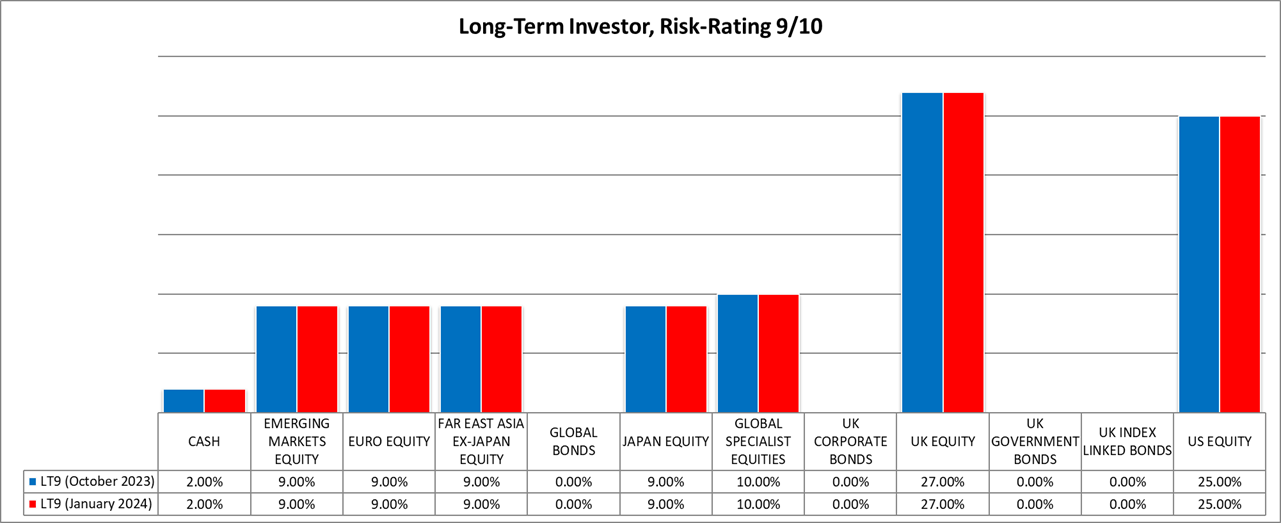

You currently have investments in this portfolio, and we show below the recommended asset allocation last quarter (blue) compared with the recommendation for this quarter (red).

Below are the current recommended funds we should hold, along with the appropriate percentage of your investment which should be allocated to this fund. You can click on the fund name to bring up a Key Investor Information Document which gives more detail on the fund

You can view historic performance of this portfolio by clicking below. You should note that this assumes changes were made as soon as the investment committee had met, and will not take into account either inflows or withdrawals from your fund. Consequently your individual performance could be better or worse, and of course past performance should not be taken as indicator of future investment returns.

Historic performance (to end of December 2023) of Long-term for risk profile 9/10

Wingate Financial Planning is a trading name of Wingate Wealth Management Ltd which is authorised and regulated by the Financial Conduct Authority. FCA Registration No: 478923. Wingate Wealth Management Limited is registered in England No 6469596.

All Rights Reserved © 2021 · Wingate Wealth Management Limited · Website by e-innovate