Projections or forecasts are a key part of most financial plans.

Although only an estimate, a forecast of the likely levels of income, expenditure, assets and liabilities in the future does enable plans to be made to meet individual objectives.

Any forecast should be as accurate as possible and should be reviewed on a regular basis as inevitably some of the assumptions may need continual fine tuning.

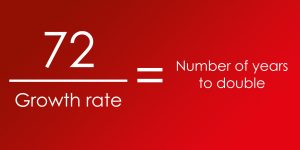

Nevertheless, a quick bit of a mental arithmetic is often helpful when taking a quick and informal overview. This is where the 72 Rule is extremely helpful.

The 72 Rule is a method of estimating how long it will take the value of a fund to double given different levels of growth. The assumed level of annual growth is simply divided into 72 to give the approximate length of time in years.

So, for example, if a fund grows at 6% each year it would take approximately 12 years to double in value, ie 72 divided by 6 equals 12 years.

If the fund grows at 4% p.a. it would double in value around every 18 years, i.e. 72 divided by 4 equals 18.

The same principle can be used in ‘reverse’.

For example, if inflation were to average 8%, the value of money would halve around every 9 years, 72 divided by 8 equals 9.

With 3% inflation money halves in value around every 24 years, 72 divided by 3 equals 24.

Get out your calculators and test this out. It is quite uncanny! Although this is of course not a means of producing detailed financial plans, it is surprising how often this quick trick is quite useful.

For a more detailed personal financial forecast please feel free to contact us.