2015.06: June Economic Review

Highlights The UK economy is expected to continue growing at a good pace Business investment at 10 year high Pay growth continues to outstrip inflation increasing real earnings CPI falls below zero for first time in fifty-five years but a prolonged period of deflation is unlikely Retail sales continue cycle of consecutive growth driven by […]

2015.05: May Economic Review

Highlights 2014 delivered the fastest rate of UK economic growth since 2006 Bank of England forecasts 2015 growth at 2.9% UK employment at all time high Lower inflation and higher earnings boost spending power UK Economic Review The UK economy grew by 2.8% in 2014 (revised upwards from earlier estimates), which represents the fastest rate […]

Should I defer my State Pension?

Like all such questions, the initial consideration is: “can you afford to defer?” I will assume that you have sufficient income or assets to maintain your standard of living without the State Pension and as such the decision to withdraw your State Pension or not focuses more around potential returns from which there are two options: […]

Could you benefit from a contribution to your pensions now?

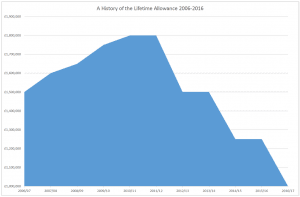

Political parties of both persuasions are threatening further attacks to on pensions in their Manifestos. This may mean taking action to increase your pension contributions, where affordable, could be advisable to head off any negative impact introduced after the general election on 7th May. The Labour party have threatened to reduce the lifetime allowance from £1 million to […]

What will the effect of the General Election be on your financial planning?

Today sees the General Election and we think whichever party forms the government an emergency budget will be scheduled for late June or early July. To this end, what actions should individuals be taking soonest, and ideally before any budget? Looking first at the mainstream planning, we consider how pensions could be affected, particularly for higher […]

Pensions lifetime allowance reducing from 2016: what actions should I be taking?

Recent Governments have a poor track record with pensions, tinkering with them as their political whim sees fit. The long-term nature of pension provisions and the (relatively) generous tax-treatment has seen pensions as the lawful prey of the Chancellor even before Gordon Brown took away the valuable dividend tax-credit. However the pace of change seems to […]

Why you should review your pension death benefit nominations – now

The pensions freedoms introduced in April of 2015 have rightly received very broad coverage, but the changes to lump sum death benefits from pensions (LSDBs) have received less. I have written on this blog on several occasions how many different changes we’ve seen to pensions; and we must be approaching more than two a year […]

New proposals do not invalidate the valuable guarantees on annuities

In his March budget the Chancellor, George Osborne announced a consultation into a Conservative proposal to allow annuities to be traded. Whilst we encourage freedom an choice in retirement these plans seem ill thought-out and likely to be of detriment to most. It is assumed that most annuitants bought an annuities for the “right” reasons […]

2015.04: April Economic Review

Highlights UK recovery remains strong Consumer spending helps to drive economic growth Business investment falls amid falling oil prices Bank of England predicts 2015 will deliver fastest rate of growth in nine years UK employment at all time high UK inflation at all time low, driven by falling fuel and food prices UK Economic Review […]

Wills – why bother?

If it is important to you what happens to your assets after you die then taking the time to establish a will is paramount. Listed below are some reasons why taking action may be of interest. Peace of mind Making a will is the only way to ensure that your savings and assets (your estate) […]