2015.09: September Economic Review

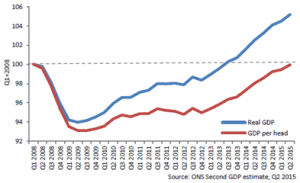

Highlights UK economic output is 5% above the 2008 pre-recession peak UK economy expanding at a solid rate Inflation remains low Real earnings continue to rise Economic Review The second official estimate for Q2 2015 growth in UK GDP was unrevised at 0.7%. UK economic output is now over 5% above its Q1 2008 pre-recession peak. Overall, […]

How to (legitimately) reduce your inheritance tax bill

We’re just waiting on the final rules that will allow some couples to pass up to £1m to their children free of inheritance tax (IHT). The rules look set to be so riddled with caveats that they erode the benefit of this improvement; if you live in Caterham and the surrounding area it’s not uncommon that you’ll […]

Pensions complification!

As if changes to the Lifetime Allowance, April 2016, and alterations to Pensions Input Periods wasn’t enough to contend with, those with earnings over £110,000 now need to be mindful as to what they can contribute into pension in the near future. Those with a passing interest in pensions may know that the Annual Allowance […]

Company owners: should you hoard cash?

Many contractors operating out of Personal Service Companies (PSC) find that a significant amount of cash reserves build up in their company bank account over time. They are often advised by their accountants to leave as much money in the business as possible, as these funds can be accessed at a heavily reduced rate of […]

An end to pensions tinkering?

Strengthening the incentive to save: a consultation on pensions tax relief was produced as part of a budget announcement in July by George Osborne. The document introduces a consultation, ending this month, on what pensions should be like for the future. I have many views, but the one I am most passionate about is to build […]

The market for immediate needs annuities becomes more restricted

We learnt today that Partnership and Just Retirement, two leading providers with respect to pension annuities, are to merge. This actually has a more significant impact, in my opinion, on the long-term care fee planning market than pension annuities. What are immediate need care fee payment plans? These plans are a type of annuity contract, but purchased […]

Buy to let: not an investment panacea

Broadly speaking, when a property is let out, costs incurred in the running of the property, as a going concern, can be fully offset against the income generated. This would include agent’s fees, insurance premiums, some maintenance, and, for now, mortgage interest. However the Government is proposing to restrict the tax relief on mortgage interest payments […]

“Relevant Property Trusts”: Ten Years On

March 2016 will represent the ten year anniversary since inheritance tax changes were introduced to trust rules. From March 2006 settlements into trusts with an interest in possession were no longer treated as Potentially Exempt Transfers (PETs) but rather as Chargeable Lifetime Transfers (CLT), which was already the case with discretionary trusts. A PET will […]

Delay of the ‘Care Cap’

The postponement of the introduction of the ‘Care Cap’ until 2020 means it is important that individuals entering long-term care should seek expert advice on funding now more than ever. At Wingate we can provide that advice and help individuals, families and/or legal representatives, such as Attorneys or deputies understand the financial consequences of someone […]

2015.08: August Economic Review

Highlights UK delivers longest period of sustained growth since before the financial crisis, with GDP now at 5.2% above the 2008 pre-recession peak Growth largely driven by the services sector Inflation likely to remain at zero over the next few months IMF predicts the UK will be the fastest growing G7 economy throughout 2015, followed […]