It’s still OK to do Film Studies!

“My children will individually be £50,000 in debt at the end of their three year university degree. They will now have to contend with 6.1% + per year of interest on the debt and so will struggle financially to pay off this sort of liability once they have completed their studies! We’ve decided that we […]

Lifetime ISAs: Buy now?

6th April 2017 saw the introduction of Lifetime ISAs in legislation, but three months into the new rules there remains very little choice, with the market offering one Cash ISA, two very restricted Investment ISAs and one “self-select” but directly administered ISA; the latter remains the likely best choice for those looking to invest for […]

Pension freedoms: Should I stay or should I go?

What does flexibility, freedom and choice in terms of financial planning mean? I take this to mean, I can do what I want with my money, when I want, without prescription and perhaps most importantly I can afford to do this. We have received many calls over the course of the last few months where […]

How much do you need in your “sweetie jars”?

The earlier in age you start saving the greater the prospect of accumulating a sizeable sum of money for your retirement years. Our experience of dealing with clients suggests that a minimum comfort level of income in retirement is £18,000 per year; providing adequate income for essentials such as utility bills, food, basic clothing and […]

Alistair Cunningham awarded Best SIPP Adviser 2017

We’re delighted to announce that Alistair Cunningham, on of Wingate Financial Planning’s Directors, last night won the ‘Best SIPP Adviser 2017’ award. The award was judged in a multi-stage process: a written submission, followed by an interview in London. In a ceremony last night, Phil Wang presented the award, saying: Alistair is clearly passionate about […]

Don’t throw away your final salary pension

Behavioural finance tells us that humans make decisions in ways that reflect their biases, and may not always operate with robot-like logic. The prospect of poor decision-making is particularly prevalent in complex decisions, especially when they are made infrequently and are irreversible. The influx of individuals looking for advice on their final salary benefits is […]

A common fallacy: trusts for the family home

If you search the internet hard enough you will find organisations based in this country who suggest that they can help you move your house into a Trust to reduce the amount of inheritance tax payable on death or to reduce care fees on moving into care. It is our view that both of these […]

Peer to peer lending – better than cash rates, worse than cash risk

With rates of return on cash still at a low point and with little prospect of an immediate interest rate rise clients will continue to be attracted to possible alternative options offering a seemingly more compelling rate of return. This can sometimes lead to rather interesting telephone conversations: I’m going to invest £30,000 into Peer […]

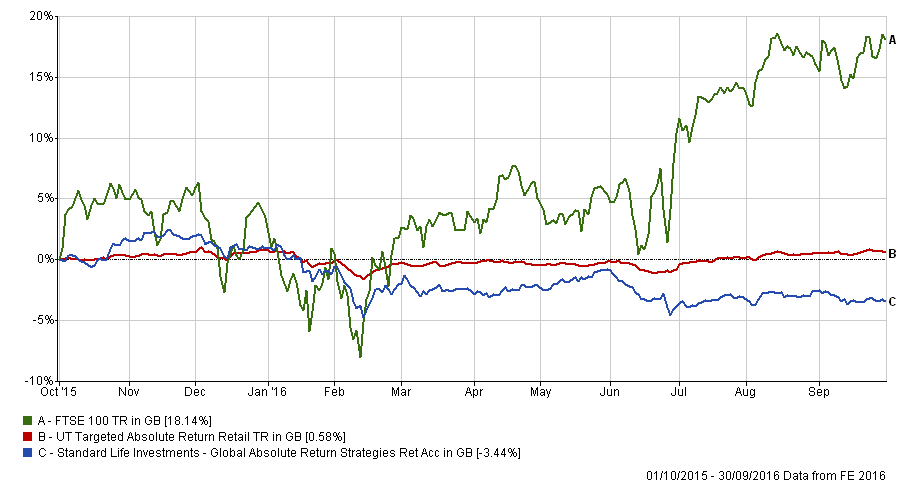

Absolutely misleading?

We have written on this blog about complex hedge fund like strategies, known as Absolute Return Funds which aim to produce positive returns over the short to medium term through a combination of complicated and opaque strategies, in many cases. The last 12 months has been a particularly unusual time period where an individual has […]

A certainity: investment markets will be uncertain

Mark Twain famously said that the only certainties are death and taxes, I would argue there is a third certainty; that investment markets will always be uncertain. As we mull over the Trump victory, it is worth considering Financial Experts and other pundits who made predictions over the high impact but unlikely event of Brexit […]