Recent Governments have a poor track record with pensions, tinkering with them as their political whim sees fit. The long-term nature of pension provisions and the (relatively) generous tax-treatment has seen pensions as the lawful prey of the Chancellor even before Gordon Brown took away the valuable dividend tax-credit. However the pace of change seems to be accelerating with around twenty changes since “pensions’ simplification” in April 2006.

In the recent budget Osborne left alone the annual allowance, the largest sum that can be paid into a pension plan in one year, but introduced a lower lifetime allowance (LTA). The lifetime allowance refers to the largest pot (without protection from prior changes) without the risk of incurring a tax charge.

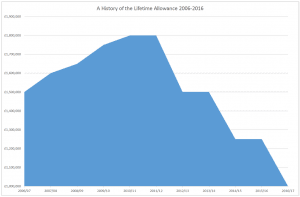

The above chart shows how the LTA has changed since 2006, when it was introduced; although the Conservative government promised to introduce annual inflation increases from 2018, Labour have said they’ll cut the LTA further (to £750,000) and even an inflation increase is likely to be lower than the growth in pension values over the longer term.

To work out your likely proximity from the LTA you need to work out the relevant values of your plans at date of crystallisation; for most people this will be the sooner of: your retirement date, date of leaving the UK permanently, death or age 75. Lump sum and money purchase (or cash balance) benefits are assessed based on the value paid out, whereas scheme pension arrangements (principally ‘defined benefit’/’final salary’ employer sponsored scheme) which are assessed against the LTA with a 20x multiple, with any lump sums added on top.

In income terms a £1 million lifetime allowance gets Final Salary (think MPs) inflation linked pension of £50,000 without any charge. In a private scheme and assuming you wanted a low risk (but expensive) option at a similar age (60) an annuity would provide about £25,000 presently. Not exactly fair – but they are the rules!

At the moment it is too early to take any action to avoid this tax; we expect we will see Fixed Protection 2016, and Individual Protection 2016, which would look similar the rules we saw in 2014. This is of course subject to final law, but could simply be summarised as:

- Fixed Protection 2016 – stop contributing to money purchase schemes, and accruing benefits in final salary schemes (care re: auto enrolment) to have a £1.25m LTA for the rest of your life (unless, of course, the normal LTA goes above £1.25m). Deadline: 5th April 2016

- Individual Protection 2016 – you may continue contributing to money purchase schemes, and accruing benefits in final salary schemes but will only have a personal LTA of the value of your fund on 5th April 2016, or if lower £1.25m. Deadline: likely beyond 6th April 2016 due to need to obtain valuations etc.

It could be useful to obtain projections and valuations now to understand the possible position as we get closer to 5th April 2016. As stated above the key it may be your position in the future that is most relevant not the position now. There are a raft of complicating factors, especially where defined benefit schemes are involved: the interference of the lifetime allowance and annual allowance factors along with the possibility of giving up (or taking early) a valuable benefit. It is also worth considering what you feel you need, for financial independence, as this may make decisions more clear.

We specialise in advice in these areas and would bear the cost of an initial discussion; this is a complex area and the above is both supposition and unlikely to reflect all personal situations.