Introduction

This document is a reference point for understanding how we provide investment advice to our clients. It is used and understood by everyone within our business, not just those responsible for the provision of advice, as it summarises not only our processes but our core beliefs and philosophies.

Each client is different, so we understand that following pre-defined processes and criteria is not suitable in circumstances where a better outcome could be achieved by alternative means. Conversely there is a distinct advantage to both the client and our business in providing some guidelines and controls around investment advice, as this ensures that advice is given in a consistent, controlled and efficient manner. This is the purpose of a written Investment Process.

The Investment Process itself is controlled by the Investment Committee which meets every three months. Changes to this process can only be made by the Investment Committee, or in exceptional circumstances by the Senior Management Team who could authorise an urgent change e.g. Managing Director and Compliance Oversight.

Investment Philosophy

An investment philosophy is the overall set of principles or strategies that guides and steers our investment decisions. It helps us to simplify a complex industry, allowing us to concentrate on our relationships with our clients, safe in the knowledge that we are doing our best to protect and grow their assets.

While investment performance hinges on many factors out of our control, most notably the return on markets, we can control other factors. These are the ones we deem the most important in creating and managing a portfolio such as the types of funds, the cost of the investments we recommend and what we look for when choosing the investment companies we recommend. It is important we can justify investment decisions to clients and make it clear why we have invested their money in a particular way. Our philosophy summarises our approach.

We provide independent advice

We chose to remain independent because we believe it is important that we are not restricted in any way at the point we recommend a product or fund to some clients. Whilst we may not believe certain types of investment are suitable for clients, because of their structure or inherent risks, it is important we are fully aware of them, understand the circumstances where they may be relevant and can advise appropriately if a client already holds such investments. We have committed to maintaining our knowledge in all product areas and this forms part of our Continuing Professional Development (CPD) programme. It is also important to us that we do not have any contractual relationships in place which require us to place business with any particular provider of products or funds, as this would compromise our independence and create a conflict of interest when providing advice.

We believe that cost is an important investment criteria

We believe that cost is a critical factor in selecting a product or investment fund as this is one of the few known criteria at outset and it has a demonstrable impact on future investment returns. Cost has an influence over our fund selection criteria.

In addition, every time an investment is bought and sold costs are incurred These may include the bid/offer spread, price effects, and stamp duty, which may not be included in the Total Expense Ratio (which assumes the funds are to be held and not traded through the period). We aim to keep the Portfolio Turnover Rate as low as possible using strategic asset allocation, and limiting the movement of funds wherever possible. The cost of a higher portfolio turnover is often hidden and taken out of investment returns.

We believe in strategic asset allocation

One of the most important investment decisions we make for clients is what assets to invest their money in. Depending on their financial goals we will build a corresponding mix of assets that produces the most appropriate level of risk and expected return. Asset allocation has a significant influence over the expected risk and return profile of a portfolio, as such it is given the highest priority within our process.

The reason why we emphasise asset allocation so much is Modern Portfolio Theory (MPT), a mathematical quantification of the benefits of diversification. It states that by combining different types of assets the collective investment will have a lower level of risk (defined as variance in investment return) than if the money was held in a single investment. This works through the assumption that the risks of different assets are not perfectly positively correlated and therefore returns may move independently from each other. For example, during a recession, equities usually fall in value, but bonds often rise; therefore a diversified portfolio will be less volatile than one made up exclusively of equity securities.

The importance of this theory for our firm is that it states that the vast majority of the behaviour of a portfolio is due to the asset allocation. Famously, in 1986 Gary Brinson, L. Randolph Hood and Gilbert Beebower (BHB) analysed the returns of 91 large U.S. pension plans between 1974 and 1983 and concluded that asset allocation explained 93.6% of the variance in returns.

We will consider passive, active and blended investment strategies

Numerous academic studies have been conducted with the aim of supporting the argument that either a passive or an active investment strategy will consistently produce superior outcomes over the long term. None of these studies have been conclusive or incontestable, and there are pros and cons of each strategy. As such we consider both a passive and an active investment strategy for our clients, as well as a blend of the two. Each client is considered in isolation, and when recommending an appropriate investment strategy consideration will be given to:

Client’s preferences – for example, the client may or may not believe that active stock selection does not deliver excess returns (over passive) in the long-term. Dependent on their view, investment experience and needs, Wingate will consider the appropriateness of either strategy or a blend of the two in meeting the clients’ needs.

Client’s situation and objectives – for example, dependent on the time horizon for the clients overall and specific time sensitive goals, Wingate will consider and recommend the investment strategy to adopt in meeting the clients needs. We would generally expect an active approach to deliver better returns over the longer term.

As active investment strategy aims to deliver excess returns, we would usually only recommend this approach for clients with ongoing financial planning needs and those who accept the additional cost of such an approach. The advantage of ‘active’ offers clients the potential for downside protection as well as the potential to outperform in all market conditions. Wingate’s Investment Committee has established a process to build ‘active’ model portfolios using ‘best of breed’ managers, which are reviewed on an ongoing basis. For these reasons, we believe that a portfolio containing a diversified range of active funds can be recommended to meet most client situations.

Fees and charges – for example, the client may feel that the possibility of achieving excess returns with active management does not warrant the additional fund management costs involved. In which case, if costs are the most important factor to the client, then a passive strategy is most likely the recommended investment solution.

Our default position for clients whose circumstances, objectives and personal preferences would not obviously result in the recommendation of an active, passive or blended investment strategy over the others would be to recommend a passive strategy as this is the lowest cost strategy.

The remainder of this document focuses on our Active Portfolio Investment Process.

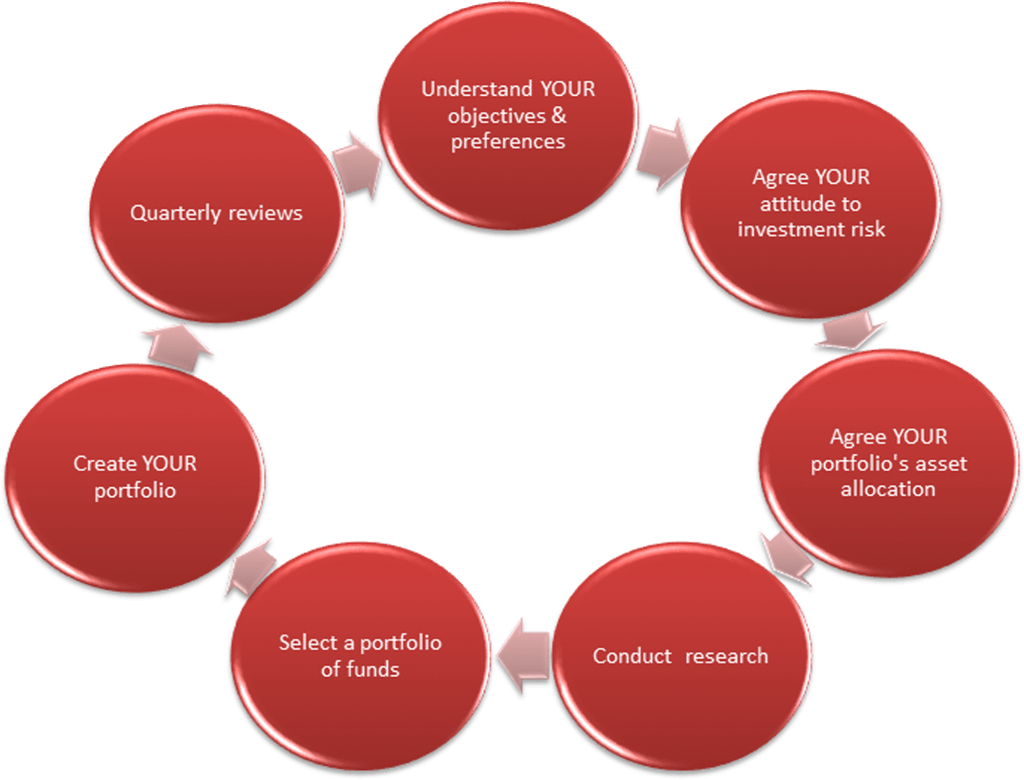

Our active investment process

Understand YOUR Objectives & Preferences: We gather pertinent data from you such as your investment objectives, investment timescale and any investment strategy preferences you may have.

Agree YOUR attitude to investment risk: The single most important element of the process is for us to understand your attitude to investment risk. We will assess your appetite for investment risk using a psychometric questionnaire and a discussion around your capacity for loss and assign you a risk rating of between 1 and 10.

Agree YOUR Portfolio’s Asset Allocation: Asset allocation is the process of balancing risk and reward by adjusting the percentage of each asset class (for example cash, equities, fixed interest, property etc.) held within a portfolio to achieve the desired risk profile. We use your risk rating and your timescale for the investment to establish the optimal asset allocation to achieve the maximum returns without exceeding the risk you are prepared to accept.

Conduct research:

There are two key elements to our fund research:

- Qualitative Research: We use OBSR independent investment research to seek out active managers expected to outperform over a full market cycle of at least 5 years

- Quantitative Analysis: Our screening process identifies funds expected to deliver above-average risk-adjusted returns at a reasonable cost.

Select a portfolio of funds: Following our fund research a shortlist of funds is identified for inclusion in the Model Portfolio.

Create YOUR portfolio: The outcome is to provide you with an efficient actively managed portfolio suitable for your risk profile and investment timescale.

Quarterly reviews: Your portfolio is reviewed and rebalanced regularly, usually quarterly. If any changes to your portfolio are recommended we write to you to confirm our recommendations and request your agreement for us to implement these.

Annual review: We will reassess your attitude to investment risk as part of your annual strategic review to ensure that the existing portfolio remains appropriate and make any adjustments necessary.

The process described is correct as at the date this piece was produced but may change in the future.