The first week of August has seen some of the largest market falls since the credit crunch began in October 2008. As I write, the FTSE100 is down nearly 10% over the week.

The first week of August has seen some of the largest market falls since the credit crunch began in October 2008. As I write, the FTSE100 is down nearly 10% over the week.

As usual the media dig out their dictionary of hyperbole, talking of ‘market freefall’; I’ve no doubt tomorrow will herald <insert random number here> wiped off the value of pension funds!

Whilst it’s possible that this could be the start of the much heralded double dip, our view is that we’re seeing a correction based on some of the information that’s been in the market for sometime; principally the spreading of sovereign debt issues, with Greece and Ireland having received bailouts. Whilst Italy is a further concern, many analysts seem to believe Spain may survive relatively unharmed. At the same time, the American Congress agreed to raise the debt ceiling, this has been done at the cost of all-time high disapproval ratings.

A little perspective

Whilst the global economies seem to be cooling, most investors forget they are not invested in the FTSE100! As a company we have great concerns that many investors take too much risk, without understanding the consequences (we live in a world where many pension fund providers think a ‘Balanced’ portfolio is 75%+ in stocks and shares). Our model portfolios are heavily diversified, and typically more conservative. Investment funds are spread across a variety of different types of assets, for example global equities, fixed interest stock, cash, and property. Our exposure to UK Equity is at the lowest point it has ever been.

Our ‘moderate (-)’ portfolio has fallen this week, of course, but is down only around 2% versus the FTSE100 fall of nearly 10%.

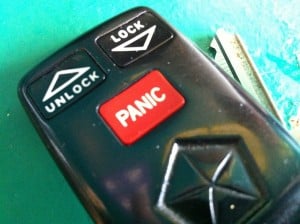

The most important thing is not to panic, markets are volatile, and exposure to volatility is necessary for long-term gains.

Actions

For most, the best thing to do is nothing. “Investments can go down as well as up” – one of the oldest axioms in the Investment world; and in respect of the FTSE, what goes down will eventually come back up, though of course over what time-frame is uncertain.

Like most (possibly all) Financial Planners, we do not have a crystal ball, and we strongly advise against market timing. Whilst the downward trend could well continue, our view is that radical changes now may simply crystallise losses.

If you have concerns we would suggest that the first step is not to panic, consider where you are invested and the level of risk you feel comfortable taking – this coupled with a financial plan that takes into account your short, medium and long-term objectives should be the road map that keeps you on track.

We provide all our clients with the tools to acheive these goals, and if you would like to discuss any of the above, in particular to reassess your exposure, please do not hesitate to contact us.