Do You Have Suitable Financial Protection?

Financial protection is commonly overlooked when individuals review their finances. However, it forms an important part of a financial plan in providing either a stream of income or a lump sum to loved ones should the worse happen. As humans, we tend not to think too much about such morbid subjects, but it is one which will impact us greatly when it does occur.

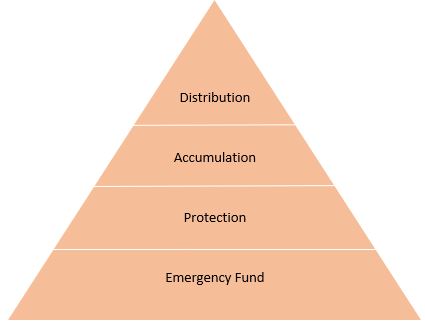

To assist my discussions with clients to highlight the importance of financial protection, I use the below Financial Planning Hierarchy of Need Pyramid:

The objective is to move up the pyramid towards financial freedom – starting with your basic and essential needs at the bottom, and once these are secured, concentrating on other matters such as savings, investments and pensions. Many people tend to focus on savings and pensions before safeguarding the essentials and family needs.

What does Financial Protection cover?

Financial protection covers a vast array of areas such as Life Assurance, Income Protection, Permanent Health Insurance, Family Income Benefit etc. Focusing on life assurance, it would pay out a lump sum upon death during the chosen term of the policy. Typically, the term would be until retirement when the need is somewhat less due to; mortgages/liabilities being paid, children are no longer dependent or other savings and pension monies available to provide a form of financial protection.

Level Term Assurance and Decreasing Term Assurance are forms of Life Assurance both paying out a defined lump sum upon the death of the policy holder. The sum assured of the former is fixed for the term, whereas for the latter the sum assured will decrease over the term and is typically linked to a capital and repayment mortgage where the liability also decreases. Monthly premiums are paid to a provider for the reassurance that should you die, the policy will accordingly pay out an agreed lump sum to your loved ones.

Questions, such as the below, are used to help determine a financial protection shortfall if any:

– What financial protection do you have in place currently?

– How would your loved ones cope financially should you die?

– How much would your loved ones actually need?

– Would you need a lump sum or a regular income stream to be paid?

At Wingate, we help individuals understand their financial protection needs, with sophisticated cash flow planning tools which visually highlight your financial future. Scenarios can be tailored to you, depicting the financial affect early death may have upon your family. If you feel this is an area of concern, or even if you have some questions you would like to ask around financial protection or Wingate’s services, please contact me directly and I would be happy to arrange a no-obligation meeting to see how I could add value and security to your financial future.