NOTE: This post is more than 12 months old, and the information contained within may no longer be accurate.

Steve Trinder

UK Highlights

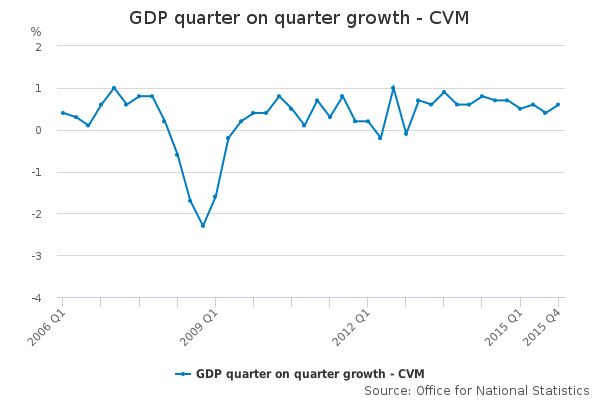

- GDP growth 0.60% Quarter on Quarter growth 2015 Q4

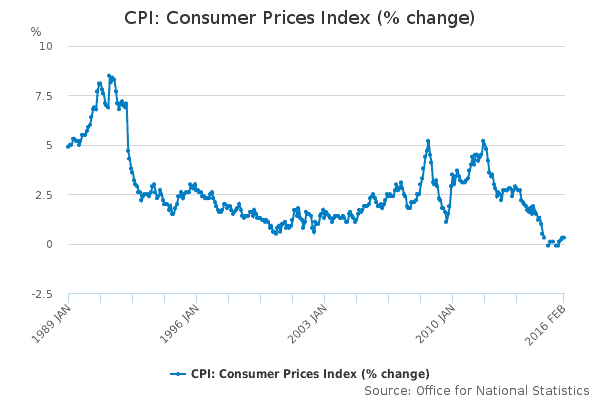

- CPI inflation has been recorded at 0.30% in February 2016

- For November 2015 to January 2016, 74.1% of people aged from 16 to 64 were in work, the highest employment rate since comparable records began in 1971.

- The unemployment rate for November 2015 to January 2016 was 5.1% lower than a year earlier (5.7%).

GDP quarter on quarter growth

GDP quarter on quarter growth

CPI Consumer Prices Index

CPI Consumer Prices Index

Investment Markets – Update

In March, most sectors returned positive results, however, some still remained negative year to date, given the volatile market conditions experienced since the start of 2016.

Below we provide a table of the major sectors that we allocate to when constructing our client portfolios. The data has been sorted over 1 month in order of best to worst returns.

| Sector | 1m | 3m | 6m | 1yr | 3yr | 5yr | 10yr |

| UT Global Emerging Markets TR in GB | 8.66 | 7.87 | 12.65 | -8.91 | -8.38 | -8.04 | 51.81 |

| UT Asia Pacific Excluding Japan TR in GB | 6.55 | 4.21 | 12.45 | -8.11 | 3.63 | 13.55 | 106.47 |

| UT European Smaller Companies TR in GB | 4.28 | 0.83 | 11.05 | 9.70 | 40.50 | 53.87 | 112.22 |

| UT Sterling High Yield TR in GB | 3.84 | 1.08 | 1.58 | -1.90 | 7.19 | 22.32 | 56.95 |

| UT UK Smaller Companies TR in GB | 3.61 | -2.45 | 0.81 | 7.62 | 36.04 | 63.05 | 103.66 |

| UT Europe Excluding UK TR in GB | 3.44 | -0.21 | 6.49 | -2.03 | 24.49 | 33.55 | 59.79 |

| UT North American Smaller Companies TR in GB | 2.77 | 0.95 | 8.19 | -6.12 | 28.02 | 52.74 | 101.97 |

| UT Sterling Corporate Bond TR in GB | 2.51 | 2.22 | 2.46 | -0.95 | 10.84 | 31.21 | 45.96 |

| UT North America TR in GB | 2.46 | 1.96 | 12.98 | 0.08 | 37.96 | 70.61 | 98.71 |

| UT UK All Companies TR in GB | 2.36 | -1.64 | 2.82 | -3.35 | 16.36 | 36.49 | 56.20 |

| UT Japan TR in GB | 1.91 | -2.58 | 9.52 | -2.61 | 19.75 | 40.24 | 7.89 |

| UT Property TR in GB | 1.81 | 1.72 | 4.29 | 3.57 | 20.98 | 28.83 | 7.72 |

| UT UK Index Linked Gilts TR in GB |

1.63 | 5.30 | 2.52 | 0.63 | 14.28 | 46.59 | 93.38 |

| UT Global Bonds TR in GB | 1.13 | 4.82 | 5.22 | 2.10 | 1.89 | 14.56 | 51.34 |

| UT UK Gilts TR in GB | 0.46 | 4.90 | 3.41 | 2.20 | 13.23 | 36.13 | 66.72 |

| UT Targeted Absolute Return TR in GB | 0.08 | -0.91 | -0.05 | -0.66 | 7.10 | 11.97 | 37.68 |