UK Highlights

GDP growth 0.50% Quarter 4 (Oct to Dec) 2015

- CPI inflation has been recorded at 0.30% in January 2016

- For October to December 2015, 74.1% of people aged from 16 to 64 were in work, the highest employment rate since comparable records began in 1971.

- The unemployment rate for October to December 2015 was 5.1%, down from 5.7% for a year earlier.

- UK Ranked 4th in standard of living across the 28 EU Countries

Summary of Producer Price Inflation, January 2016

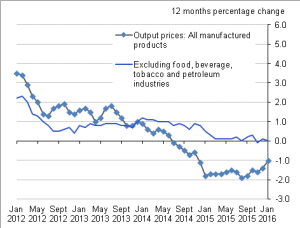

Output price “factory gate” annual inflation for all manufactured products 1.0% in the year to January 2016, compared with a fall of 1.4% in the year to December 2015.

Month on month the output price measure for all manufactured products decreased 0.1% between December 2015 and January 2016, compared with a decrease of 0.3% last month.

The “narrow” output price measure, which leaves out volatile sectors, showed no movement in the year to January 2016, compared with a fall of 0.1% in the year to December 2015.

UK, January 2012 to January 2016

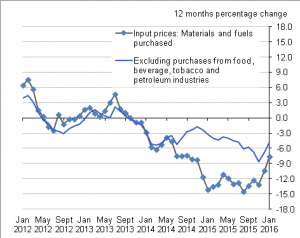

Input price annual inflation fell 7.6% in the year to January 2016, compared with a fall of 10.4% in the year to December 2015.

Month on month, the input price measure of UK manufacturers’ materials and fuels, fell 0.7% between December 2015 and January 2016, compared with a fall of 0.3% last month.

The “narrow” input price measure fell 4.7% in the year to January 2016. In seasonally adjusted terms the price rose 0.6% between December 2015 and January 2016.

Source: Office for National Statistics

World Economic Outlook – Update

Global growth, currently estimated at 3.1 percent in 2015, is projected at 3.4 percent in 2016 and 3.6 percent in 2017. The pickup in global activity is projected to be more gradual than in the October 2015 World Economic Outlook (WEO), especially in emerging market and developing economies.

In advanced economies, a modest and uneven recovery is expected to continue, with a gradual further narrowing of output gaps. The picture for emerging market and developing economies is diverse but in many cases challenging. The slowdown and rebalancing of the Chinese economy, lower commodity prices, and strains in some large emerging market economies will continue to weigh on growth prospects in 2016–17. The projected pickup in growth in the next two years — despite the ongoing slowdown in China — primarily reflects forecasts of a gradual improvement of growth rates in countries currently in economic distress, notably Brazil, Russia, and some countries in the Middle East, though even this projected partial recovery could be frustrated by new economic or political shocks.

Risks to the global outlook remain tilted to the downside and relate to ongoing adjustments in the global economy: a generalized slowdown in emerging market economies, China’s rebalancing, lower commodity prices, and the gradual exit from extraordinarily accommodative monetary conditions in the United States. If these key challenges are not successfully managed, global growth could be derailed.