Highlights

- The UK economy continues to grow at a reasonable rate

- GDP growth in Q3 2015 was almost entirely driven by the services sector

- UK employment is at its highest since records began

- Real wages are now rising at a good rate and will help to support consumer spending, a key driver of UK growth

- The slowdown in China looks set to continue

- The IMF predicts the US will be the fastest growing economy in the G7 this year, followed closely by the UK

- The MPC are under little pressure to raise interest rates anytime soon

Economic Review

UK GDP grew by 0.5% in Q3 2015, slower than the previous quarter. However, despite the slowdown UK economic output is now 6.4% above its Q1 2008 pre-recession peak. Overall, the latest GDP figures confirm that the UK economy is growing at a reasonable rate.

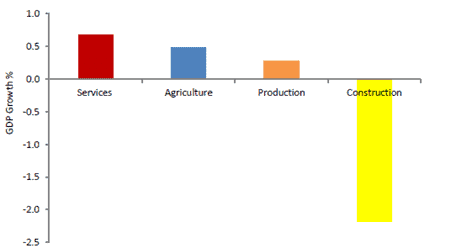

Although output rose in three of the four main industrial grouping, GDP growth in Q3 2015 was almost entirely driven by the services sector, which accounts for over three quarters of UK GDP. In contrast, the construction sector was a drag on growth with output declining, knocking 0.1% off the overall figure.

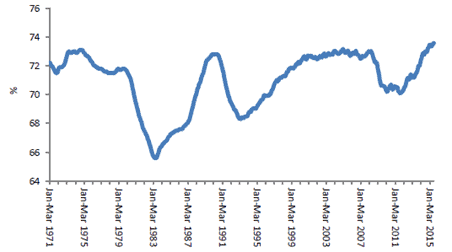

In the three months to August 2015 the UK’s youth unemployment rate fell from 15.9% to 14.8%. The UK’s total employment rate currently stands at 73.6%, the highest proportion since records began in 1971.

CPI inflation fell from 0.0% in August to -0.1% in September, the second month this year that inflation has moved into negative territory. A smaller than usual rise in clothing prices and falling motor fuel prices were the main contributors. With inflation continuing to hover around 0% and total annual pay growth rising from 2.9% to 3.0% in the three months to August, real wages are now rising at a good rate and will help support consumer spending, a key driver of UK growth.

Eleven out of the nineteen countries in the Eurozone are currently experiencing deflation. The fall in oil prices over the last year has been the major driver behind the fall in both UK and global inflation.

China has been hit by stock market volatility, a weakening economy and is also attempting to rebalance its economy away from exports to consumer spending. Despite the announcement of a further cut in Chinese interest rates, the slowdown in China looks set to continue and is a major risk to global growth prospects.

The IMF has downgraded its forecast for global growth, and now predicts that the US will be the fastest-growing economy in the G7 this year, followed by the UK.

The Monetary Policy Committee (MPC) are now less likely to consider raising UK interest rates, which have been on hold since March 2009, for the foreseeable future. Furthermore, with UK inflation close to 0% and likely to remain below the 2% inflation target until well into 2017, the MPC are under little pressure to raise interest rates anytime soon.

Investment Outlook

Global market overview

Global equity markets clawed their way back to near record highs in October, after several central banks around the world sought to stem rising concerns over the health of the global economy, by unveiling, or hinting at, more supportive monetary policy.

UK Equities

- The US equity market regained much of the ground lost during the summer

- Better-than-expected corporate earnings results boosted optimism on the health of corporate America

- US consumers continued to spend at a robust pace

European Equities

- European equity markets rallied in October

- The technology sector was the leading outperformer, followed by consumer goods

- Eurozone unemployment dropped to 10.8%, the lowest level since 2012

UK Equities

- UK equity prices rebounded as China fears abate

- GDP growth slowed in Q3 – as manufacturing and construction output slows

- Negative UK inflation and low inflation internationally pushed out a rise in UK interest rates

Asian Equities

- Asian equity markets regained some lost ground

- China policy announcements helped stabilise investor sentiment

- Japan’s equity market rebounded although economic indicators remained mixed

Emerging Markets

- Global emerging equity markets bounced back in October

- Gains led by the emerging Asia region, as China cut interest rates again

- Eurosceptic Law and Justice party won general election in Poland

Fixed Interest

- US Federal Reserve signalled a potential rise in interest rates by December

- European Central Bank hinted at possible further monetary stimulus measures

- Corporate bonds rallied, but individual company volatility remained