We have written on this blog about complex hedge fund like strategies, known as Absolute Return Funds which aim to produce positive returns over the short to medium term through a combination of complicated and opaque strategies, in many cases.

The last 12 months has been a particularly unusual time period where an individual has seen significant positive investment growth even in very cautious investment strategies, outside of Sterling cash.

However, Absolute Return Funds have failed to impress over this period.

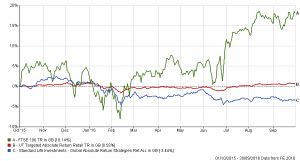

The chart below shows the track record of the index over a 12 month period up to the end of September, and for comparison a simple multi asset passive fund is shown as well. The largest fund in this sector, the Standard Life Global Absolute strategies has returned negative 6.3% and is also shown separately on the graph. These funds are often amongst the most expensive, and whilst they profess to give a level of diversification outside of other strategies, we do not remain convinced this is the case.

What is even more concerning is that these funds have started to seek into more simple investment strategies, for example, default funds in Group Personal Pension Schemes and other employer sponsored arrangements and we feel that an individual should seek tailored advice before investing in such an arrangement.

At Wingate we believe in a diverse, and understandable investment portfolio. We do not believe in fads or funds that sound to good to be true. We would be happy to discuss any of the topics raised by this blog.