Highlights

- UK growth down from 2014 levels

- UK unemployment low, employment high

- Inflation likely to remain at near-zero levels for the next few months

- Risks of “Brexit”, and other geo-political risk mean increased volatility over 2016

UK Economic Review

GDP growth in the final quarter of 2015 was confirmed by the ONS to be 0.5%. GDP grew by 2.2% in 2015, down from 2.9% in 2014, with household consumption and investment the main contributors to growth.

Employment rate, ages 16 to 64, 3 months to February 1995 to 3 months to December 2015

Unemployment is at a historic low and is back to its pre-downturn average. Nominal and real wage growth have both eased a little in recent months, although the ONS state this may in part reflect rising job flows into low-skilled occupations.

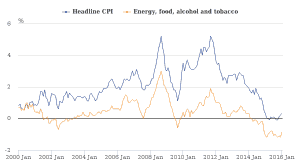

Headline Consumer Prices Index (CPI) inflation rose marginally in January 2016 but remained well below the official inflation target of 2%. The low level of inflation over the past year has been primarily due to falling prices for energy, which appears to have fed through to prices for fuel in transport, and food. The appreciation of sterling during the first half of 2015 also served to hold down import prices, which has its biggest impact on imported raw materials, energy and some manufactured goods.

Headline CPI inflation and contribution from energy, food, alcohol and tobacco (12 month percentage change), January 2000 to January 2016

Year-on-year retail sales growth (excluding fuel) for the 3 months to January 2016 – around the Christmas period – weakened from 5.5% in 2015 to 3.3% in 2016. The growth in retail sales, excluding fuels, came from predominantly food stores, non-specialised non-food stores, household goods stores and non-store retailing, so fairly broad-based.

Global Investment Outlook

February saw significant market volatility, caused principally by growing risks systemic in the global economy; principally:

- Fears of continued Chinese economic downturns and currency devaluation

- A significant fall in oil prices and the potential knock-on effect for credit risk in the USA

- The rise in the dollar and its impact on some emerging countries, which have significant dollar-denominated debt

- Geopolitical risks, such as rising tensions in the middle east

Markets are likely to remain volatile and investors will be nervous until things stabilise. The US and the UK economies look broadly positive, and should (subject to the risks above) continue their modest trajectory of growth and the European and Japanese ‘green shoots’ should continue.